Tax Savings on Insurance

Introduction

- Start by introducing the importance and relevance of income tax savings for individuals.

- Mention that life insurance can be a powerful tool for maximizing these savings.

- Set the stage for the main content by highlighting the benefits and strategies for utilizing life insurance to save on income tax.

Understanding Income Tax Savings

- Briefly explain what income tax savings are and why they are important for individuals.

- Highlight that income tax is a significant expense for many people and finding ways to reduce it can have a positive impact on their finances.

- Mention that life insurance presents unique opportunities for saving on income tax.

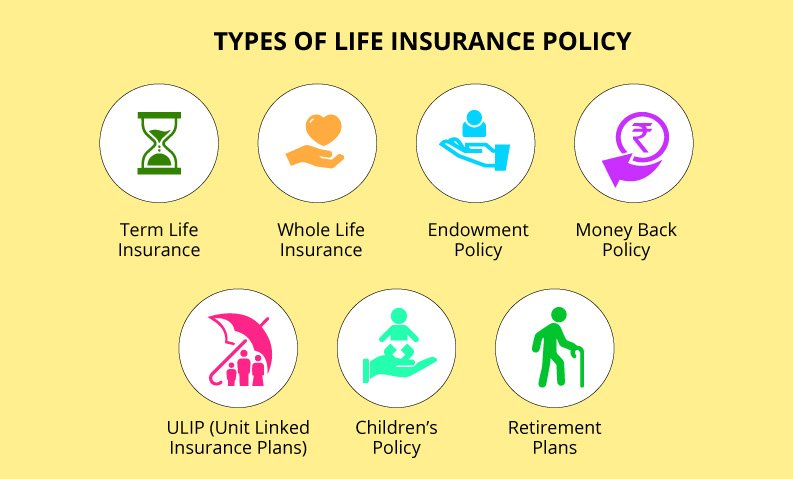

Types of Life Insurance

- Outline the different types of life insurance available, such as term life insurance and whole life insurance.

- Explain the key differences between these types, including the duration of coverage and potential cash value accumulation.

- Emphasize that the type of life insurance an individual chooses can have implications for their income tax savings.

Tax Benefits of Life Insurance

- Detail the specific tax benefits of life insurance that can contribute to income tax savings.

- Highlight the tax-free nature of the death benefit, which means that beneficiaries do not have to pay income tax on the proceeds.

- Explain how cash value growth in certain types of life insurance policies can accumulate tax-deferred, offering potential income tax savings.

Utilizing Life Insurance for Income Tax Savings

- Provide strategies for utilizing life insurance to maximize income tax savings.

- Discuss the importance of proper planning and consulting with a financial advisor when considering life insurance for tax purposes.

- Mention that individuals can potentially leverage their policy’s cash value to supplement retirement income in a tax-efficient manner.

Case Study: Jane’s Experience

- Share a hypothetical case study of an individual named Jane who utilized life insurance for income tax savings.

- Detail Jane’s specific situation, including her income tax bracket, financial goals, and insurance policy choice.

- Explain how Jane was able to significantly reduce her income tax liability by leveraging various tax benefits offered by her life insurance policy.

Conclusion

- Summarize the main points discussed in the blog post, highlighting the importance and benefits of utilizing life insurance for income tax savings.

- Encourage readers to explore this strategy further by consulting with a financial advisor and researching different life insurance options.

- End with a memorable statement or call to action, urging readers to take advantage of the potential income tax savings offered by life insurance.

Best savings in income tax using life insurance

Introduction

As individuals, we all strive to reduce our income tax burden. Finding ways to save on income tax can help us free up funds for other important financial goals. One often overlooked strategy for maximizing income tax savings is through the use of life insurance. In this blog post, we will explore the various benefits and strategies of using life insurance for income tax savings.

Understanding Income Tax Savings

Income tax is one of the largest expenses for many individuals. It is important to understand the concept of income tax savings and the impact it can have on our overall financial well-being. By reducing our income tax liability, we have more money to allocate toward other financial priorities, such as saving for retirement or paying off debt. Life insurance can play a crucial role in achieving these goals.

Types of Life Insurance

Before diving into the specific tax benefits of life insurance, let’s first understand the different types available. There are primarily two types of life insurance: term life insurance and whole life insurance. Term life insurance provides coverage for a specific period, while whole life insurance provides lifetime coverage and may accumulate cash value over time. The type of life insurance an individual chooses can have implications for their income tax savings.

Tax Benefits of Life Insurance

One of the key tax benefits of life insurance is the tax-free nature of the death benefit. When the insured individual passes away, the death benefit paid to the beneficiaries is typically not subject to income tax. This ensures that the intended recipients receive the full amount of the policy proceeds. Additionally, certain types of life insurance policies offer the opportunity for cash value growth, which can accumulate tax-deferred. This means that individuals can potentially grow their policy’s cash value without incurring immediate income tax.

Utilizing Life Insurance for Income Tax Savings

To effectively utilize life insurance for income tax savings, proper planning is essential. Consulting with a financial advisor who specializes in insurance and tax planning can provide valuable guidance. One strategy is to leverage the cash value of a life insurance policy as a supplemental source of retirement income. By taking loans or partial withdrawals from the policy’s cash value, individuals can potentially reduce their taxable income in retirement. This can be particularly beneficial for individuals in higher income tax brackets.

Case Study: Jane’s Experience

Let’s take a look at a hypothetical case study to illustrate the potential income tax savings of using life insurance. Meet Jane, a successful business owner in the top income tax bracket. Jane consulted with a financial advisor and opted for a whole life insurance policy. By leveraging the cash value growth of her policy, Jane was able to supplement her retirement income in a tax-efficient manner. This strategy helped significantly reduce Jane’s income tax liability, allowing her to enjoy a more comfortable retirement.

Conclusion

In conclusion, life insurance can be a powerful tool for maximizing income tax savings. By understanding the tax benefits of life insurance and utilizing the right strategies, individuals can significantly reduce their income tax liability. It is important to consult with a financial advisor to ensure proper planning and explore the different life insurance options available. Don’t miss out on the potential benefits of using life insurance for income tax savings. Start exploring this strategy today and unlock new possibilities for your financial future.