To amend the information provided in the core fields during registration, you need to perform the following steps:

- Access the gst portal by entering the www.gst.gov.in.

- Login into GST account with correct username and password.

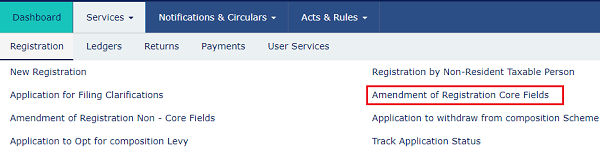

- Click the Services> Registration > Amendment of Registration Core Fields link.

As per requirement, the Taxpayer can amend information in the editable fields in the tabs as mentioned below:

Business Details tab:

The Business Details tab is selected by default.

a) Select the field which you wish to edit by clicking on the Edit icon (white black pen icon).

b) Edit the desired details and select the DATE OF AMENDMENT using the calendar.

c) In the REASON field, enter the reason for amendment of information provided in the Core fields.

d) Click the SAVE

Principal Place of Business tab:

a) Scroll down the page and click the EDIT button.

The form is displayed for editing. Edit the desired fields.

b) In the Reasons field, enter the reason for amendment of information.

c) Select the Date of Amendment using the calendar.

d) Click the SAVE button.

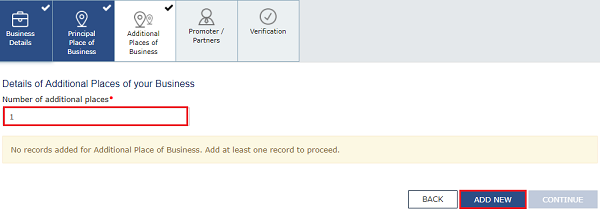

Additional Places of Business tab:

a) In the Number of additional places field, enter the number of additional places for which information is to be added.

b) Click the ADD NEW button.

The form is displayed for editing. Edit the desired details.

b) In the Reasons field, enter the reason for amendment in information. Note: In case of amendment relating to additional place of business, no documents are required to be uploaded.

c) Select the Date of Amendment using the calendar.

d) Click the SAVE & CONTINUE button.

e) Click the SAVE button. Note: You can click the EDIT and DELETE button to edit or delete the additional place of business

In the Promoter / Partners tab, click the VIEW button to see details about the Promoter or Partners. To edit the details of Promoter or Partners, click the EDIT button. To delete the details of Promoter or Partners, click the DELETE button.

a) Click the ADD NEW button to add details of Promoter or Partners.

b) Enter the details of the Promoter/Partner and upload the necessary documents required as a proof for amendment.

c) In the Reasons field, enter the reason for amendment in information.

d) Select the Date of Amendment using the calendar. e) Click the SAVE Button.

f) Once details are added, click the CONTINUE Button. Verification tab:

4. In the Verification tab, select the Verification checkbox.

5. In the Name of Authorized Signatory drop-down list, select the authorized signatory.

6. In the Place field, enter the name of the place.

The application for Amendment of Registration must be digitally signed using a Digital Signature Certificate (DSC), E-Signature, or Electronic Validation Code (EVC).

After submitting a digitally signed application for amendment of registration, the message of successful submission appears. The acknowledgement will be sent to your registered e-mail address and mobile phone number in 15 minutes. ARN and successful filing of the Form will be notified by SMS and email to the primary authorized signatory.

Tax Officials must approve amendments to Core fields. A notification will be sent to you via SMS and e-mail once the amendment application has been approved or rejected.. The taxpayer will also be able to download an amended registration certificate containing the amended details from his dashboard.